Yesterday, Vox.com’s Matthew Yglesias published an article about a chart on our website which appeared to reveal a decline in capital investment in cable infrastructure over the last five years. After taking a close look at the chart, we can see how Yglesias arrived at this conclusion, because the chart had a few simple errors.

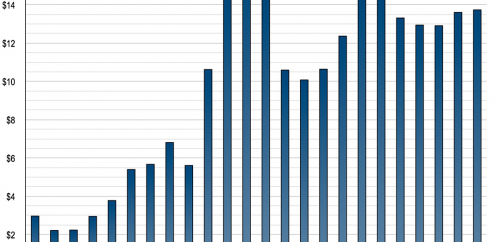

We’ve gone ahead and updated and reposted an accurate chart which tells a positive story about how light regulation has led to healthy and growing investment in broadband networks. We’ve also posted above the full data set which shows annual infrastructure investment figures since 1990 and demonstrates that there is a clear and sustained level of investment.

The bottom line is that cable’s broadband invest has remained significant and steady, and is on the upswing. Data from SNL Kagan, an independent third party, show cap-ex over the last two years is six percent higher than 2011, a number that is expected to continue at or around the current pace for the foreseeable future.

Since 1996, cable has invested $213 billion in infrastructure growth building out a nationwide fiber-rich broadband network that millions of consumers enjoy every day. Infrastructure investment is cyclical in nature but over the last seven years, capital investment levels have ranged between $13 billion and $14.5 billion, and the levels for the last two years were higher than the previous three years. The cable industry has and will continue to invest billions annually to build vibrant broadband networks that continue to increase in speed and scope.

With growing consumer demand for Gigabit Wi-Fi and cable’s ultra-fast Gigasphere service, that virtuous cycle of investment and improvement will only continue provided we stay true to a regulatory model premised on marketplace competition, and not 19th Century regulation.