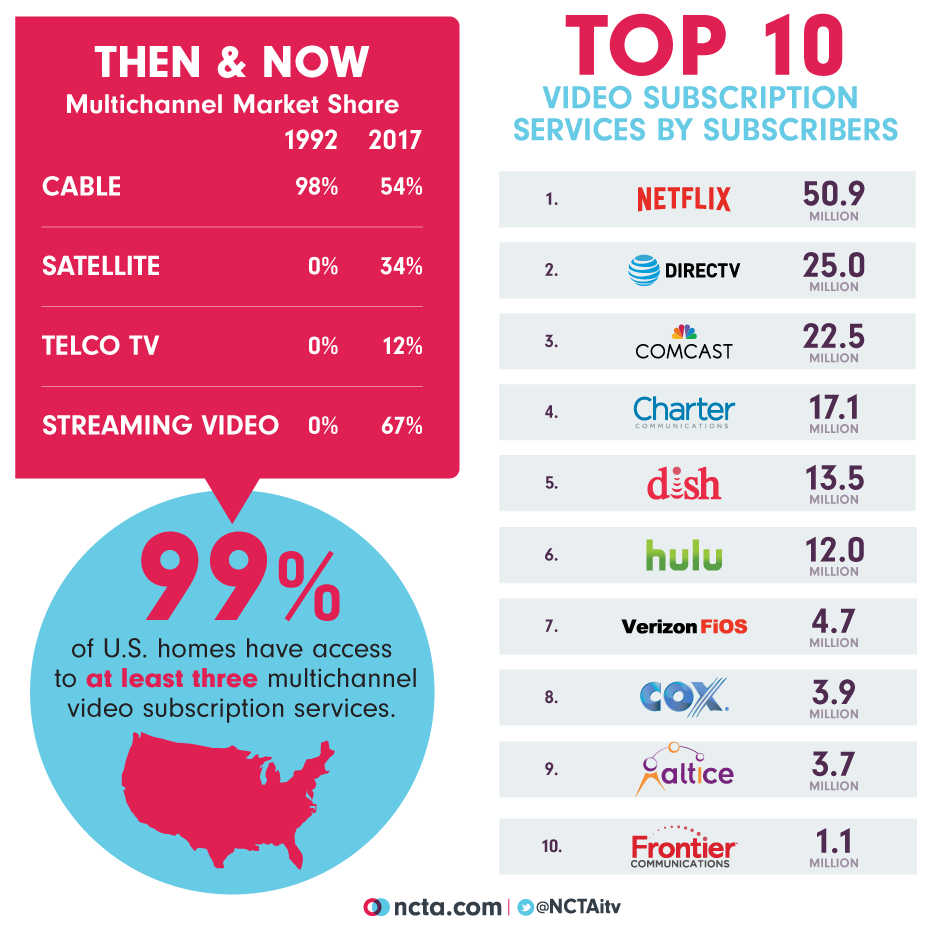

In 1992, 98 percent of American homes relied on cable to watch subscription TV. There were no satellite TV options or telco-provided TV options. There certainly weren’t internet streaming options because, among other reasons, broadband wouldn’t be launched for another four years. It would be a full decade after that before a video streaming service would be made available.

25 years later, the TV marketplace is undeniably different. Technologies like cloud DVRs, apps, and TV Everywhere have transformed the way we watch television. Many of the best content creators are choosing TV to tell their stories. But perhaps most noticeably, the marketplace has become robustly competitive. According to the FCC, 99 percent of U.S. homes have access to at least three multi-channel subscription TV services. Cable’s historic dominance has dissipated into a market where 54 percent of homes with multichannel video services are cable video customers, 34 percent are satellite video customers, and 12 percent are telco TV customers.

Not so coincidentally, as fast broadband networks have become ubiquitous throughout America, additional pay TV competition has emerged from new players who use the internet to deliver programming. The dominant player is Netflix, a premium streaming service that has become an entertainment powerhouse. It has 50.9 million U.S. subscribers, more than the entire cable industry. The next largest video service provider, AT&T/DirecTV has less than half that, 25 million. And Comcast, the largest cable video provider has 22.5 million customers.

Competition isn’t just the rule in television, it defines broadband markets as well. In spite of living in one of the largest and most rural nations, 88 percent of American consumers can choose from at least two wired internet service providers. When you include competition from mobile and satellite broadband providers, much of America is home to multiple competing ISPs leveraging different and ever-improving technologies. This competition has led to rapid progress in the quality of consumer internet connections with average peak speeds in America quadrupling over the last five years, from 23.4 Mbps to 86.5 Mbps and the average price per megabit dropping 90 percent in 10 years, from $9.01 per megabit per second to $0.89 per megabit per second.

Over the last 25 years, Americans have gone from a relatively sparse video marketplace with few alternatives to watch premium TV to literally dozens of choices. And from screeching, sluggish dial-up internet access to multi-gigabit broadband internet. Today, creators and distributors fight for a share of America’s eyeballs in one of the fastest moving and most innovative business spaces in history. The result has been better TV programming, robust broadband access, and more affordable options.

Competition is alive and well in the TV and internet marketplaces and consumers are benefiting every day.